Be a Boise Insider

Receive weekly updates, luxury listings, and insider tips on Boise real estate right to your inbox.

What You Need to Know About Your Property Tax Assessment

Ada County homeowners will be receiving their property tax assessments in early June. The Ada County Assessor's Office is required by law to estimate the full market value of all property within the county for property tax purposes and then notify property owners of our market value estimates. The

Categories

- All Blogs (323)

- 1st thursday (1)

- 30thanniversary (1)

- activities (182)

- agents (17)

- announcement (1)

- apartment (1)

- april (2)

- architecture (3)

- art (10)

- art festival (2)

- article (1)

- august (3)

- awards (3)

- beer (7)

- biking (1)

- boise (173)

- Boiseevents (146)

- boisehousing (12)

- boiseriver (13)

- brew festival (6)

- buyers (36)

- campgrounds (1)

- camping (2)

- cars (3)

- charity (1)

- children (27)

- christmas (5)

- cincodemayo (1)

- coffee (2)

- communities (9)

- concert (9)

- condominium (1)

- couples (4)

- design (1)

- development (4)

- dogs (1)

- downtownboise (68)

- downtownyproject (1)

- eagle (12)

- east boise (1)

- easter (2)

- event (19)

- fair (12)

- fall (15)

- family (7)

- familyfriendly (69)

- farmersmarket (16)

- Father's Day (2)

- fathersday (1)

- fest (6)

- festival (8)

- film (1)

- flowers (1)

- food (12)

- funfacts (2)

- galentines (3)

- garden (6)

- halloween (1)

- holiday (15)

- holidays (24)

- homechecklist (19)

- homeowner (2)

- hotsprings (3)

- housing (20)

- idaho (39)

- idaholife (102)

- idaholifestyle (111)

- july4th (4)

- kids (22)

- laborday (1)

- landmarks (1)

- LBRE (1)

- lifestyle (90)

- listings (16)

- livelocal (51)

- luxury (8)

- Mandy (1)

- market (16)

- markettrend (1)

- marketupdate (13)

- may (2)

- memorial day (1)

- meridian (1)

- mortgage (3)

- mothersday (2)

- mountain (1)

- movies (4)

- museum (4)

- music (8)

- music festival (14)

- musical (1)

- nampa (3)

- NAR Settlement (1)

- neighborhoods (32)

- news (1)

- open house tour (1)

- outdoorrecreation (91)

- outdoors (96)

- parks (48)

- pets (1)

- pool (1)

- property taxes (1)

- ranking (1)

- realestate (51)

- realestatemarket (31)

- recreation (100)

- restaurants (29)

- review (1)

- run (1)

- sellers (38)

- september (3)

- shoplocal (28)

- shops (38)

- spring (8)

- st patrick's day (2)

- stores (1)

- summer (15)

- team (2)

- thanksgiving day (3)

- thingstodo (189)

- tips (114)

- trails (1)

- treasure valley (11)

- trends (8)

- vacation (1)

- valentines (7)

- waterpark (1)

- wine (13)

- winery (11)

- winter (23)

- women's month (1)

- zoo (1)

Recent Posts

Luxury Hot Springs Havens to Add to Your Bucket List

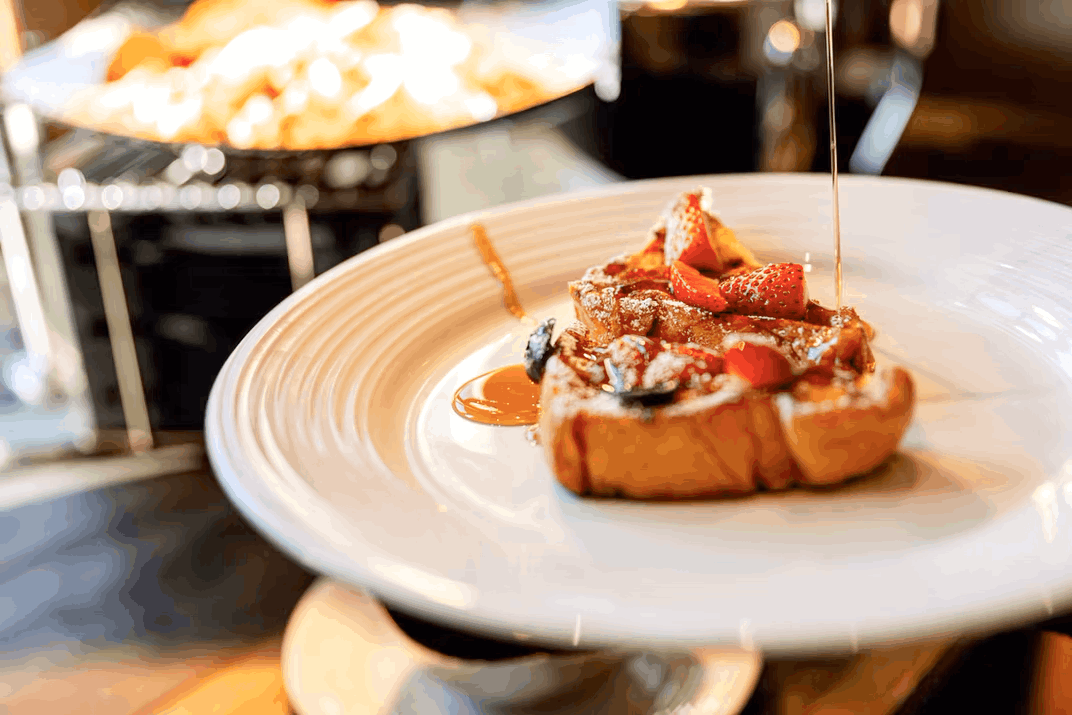

Easter Brunching in Boise

Events in Boise & Beyond - April 4th - 6th

Events in Boise & Beyond - March 28th - 30th

Quiet Luxury—The Elegant Design Trend

Boise's Best Spring Events

Events in Boise & Beyond - March 21st - 23rd

Level Up Your Home's Luxury Feel

Ten Mile Road’s Emerging Role in the Treasure Valley

Events in Boise & Beyond - March 14th - 16th